Investment Planning

1. Be Specific

Define your objectives for the goal and be realistic in setting that goal.

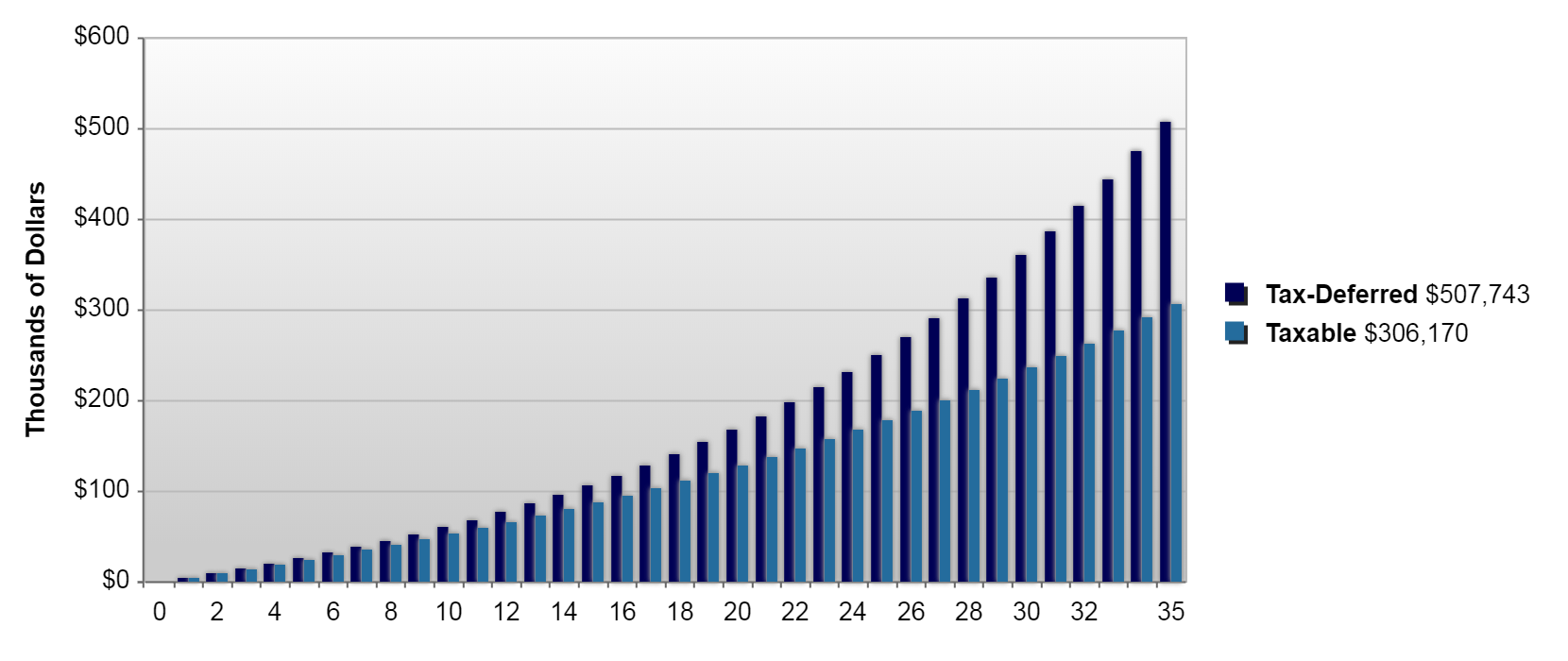

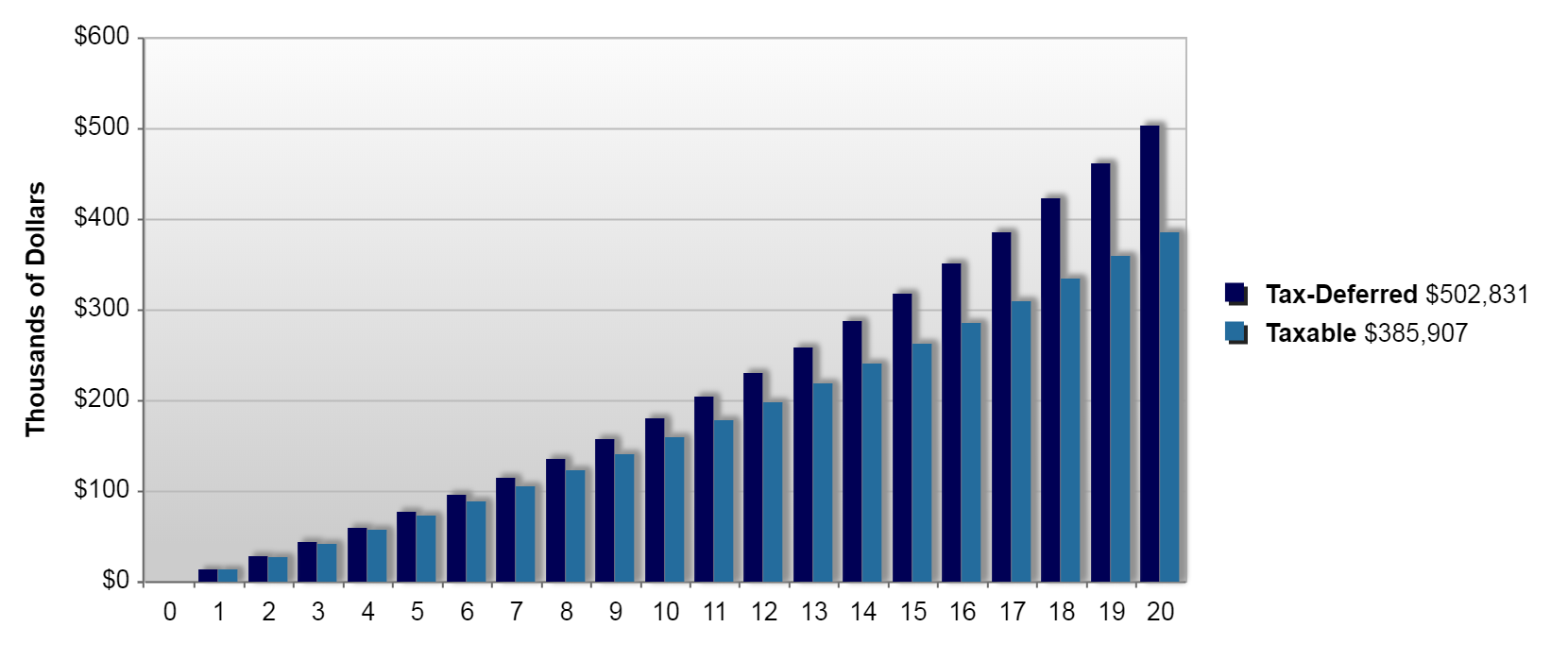

For example, instead of saying you want to have enough money to retire comfortably, think about how much money you’ll need. Your specific goal may be to save $500,000 by the time you’re 65.

2. Calculate

How much you need to save each pay cheque to achieve that goal.

To achieve $500,000 starting at age 30 you need to invest $170 bi-weekly. If you start at 40 you would need to save $510 every two weeks. Is that a realistic amount for you to set aside each pay period? If not, you may need to adjust your goals. (Assuming 6% return).

3. Choose Your Investment Strategy

With the assistance of one of our Advisors, we can help you find the right solutions. If you’re saving for long-term goals, you might choose more aggressive, higher-risk investments. If your goals are short-term, you might choose lower-risk, conservative investments. Or you might want to take a more balanced approach.

4. Monitor and Track Your Progress

*Graphics provide by https://www.dinkytown.net/java/ca.html